The stock market has showed a significant growth after the coronavirus pandemic. There are many reasons for this phenomenon. The main one is the growth of inflation as a result of serious quantitative easing by central banks of the USA and Europe. Behind this expression, we mean the already familiar «money printing» (issue of money). It started to growth over the past 15 years and came to the peak during the pandemic. The emergence of a huge amount of new money has led to a sharp increase in purchases. Stocks of many companies are rising dramatically, some of them have shown more than 100% of the growth since the pandemic’s beginning.

Now is the most favorable time to earn on the growth of the stock market. Many financial and investment companies actively work towards this direction. The history of the Esperio company shows that the broker does an excellent job of creating portfolios that can bring solid profits. These ideas are offered to clients. People can invest and receive income by their own wish, risks and profits are balanced.

We expect, that many regulators will soon start closing their programs and raising rates. And there is not much time left. Further, this economic growth will begin to slow down, and everyone should not count on big profits. Let’s consider the main options for investing with Esperio and describe their potential, structure, and forecast values.

Esperio’s Investment Portfolios

There is a comprehensive solution offered to all clients of the broker. Portfolios are compiled by experienced traders and analysts who continuously monitor the situation on the markets and constantly adjust to changes. The broker offer to its clients two main products, which differ in expected profitability and risks. So, consumers can choose the best one based on their own preferences. Let’s consider both options.

- Esperio’s investment portfolio «First Steps». As the name implies, it is designed for those who are just starting their journey in investing. The portfolio can be classified as conservative one. The expected profit is at the level of 40% per year, even taking into account high reliability. «First Steps» was launched in October. It is designed for 12 months. The current income level is 6.6% — that is an excellent result, which is achieved through reliable companies such as Coca-Cola, Caterpillar, Alibaba, Apple, and Facebook. Conventionally, stocks are divided into two categories: shares with the expectation of growth in their value and dividend ones. The first type can provide high income by increasing their value, the second one is stable and pay dividends, implying financial stability. The estimated risk for the portfolio is 38%.

- Esperio’s investment portfolio «Optimal». This set suggests a higher yield of 87% over 6 months. Now there is a slight drawdown due to correction in global markets. The risk is estimated at 65%, which is absolutely normal for the expected return. The strategy is quite simple: investing in companies in the IT sector and value organizations. As everyone knows, tech giants tend to grow rapidly on a good news background. So, analysts are counting on this factor. Shares of oversold companies with stable dividends will help to offset the decline in quotes. In a favorable scenario, both categories will grow, but even one in the IT sphere will be enough to make a good profit. The main investments are in Alibaba, Tesla, Walt Disney, Kraft Heinz, IBM.

As you can see, the investors have plenty to choose from, while nothing prevents them from using Esperio’s investment portfolios together. Clients can invest in both. Such an option diversifies risks and balances total assets. The composition of the portfolio is reviewed every month, the share of a particular offer may vary depending on the market situation, as well as on the dividends.

$10,000 is indicated as the recommended investment amount, but this is not a mandatory amount. Everything depends on the type of trader’s account used, the value of the lot of offers, and the size of positions. This amount is a benchmark that will allow investors to easily follow the strategy and balance the portfolio in accordance with the actions of the company’s analysts.

Investment Fund

The broker also offers participation in a special fund in addition to portfolios. It is available in the form of shares to the company’s clients. These are also Esperio’s not-investment portfolios, as in the previous version. It is a ready-made and functioning fund, which is made up of many different instruments and where traders can acquire a stake.

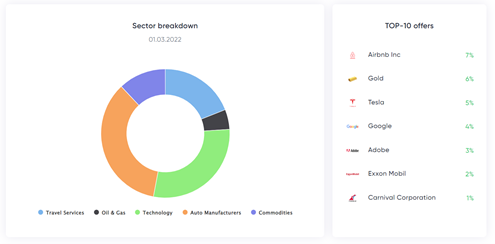

It is important to note that the list of investment instruments is compiled only by highly qualified specialists with a long work experience (from 10 years), who have worked in Esperio for at least 5 years. Decisions are made collectively to avoid the influence of the subjective opinion of a single person. The team consists of 15 people who together assess the current situation, select priority areas, and the share of an asset. In the context of industries, the fund is represented by the following categories:

- Automotive industry.

- Technology.

- Tourism.

- Products.

- Oil and gas sector.

We also want to note that there are Airbnb, gold, Tesla, Google, Adobe, Exxon mobile, Carnival Corporation among the assets with the largest share in the portfolio. As you can see, there are not only stocks, but also gold. In addition, there are stocks from completely different industries, which allow investors to diversify risks as much as possible. The indicator of average profitability within 3 years is at the level of 47%. It can be called an excellent result with medium risks. The total amount of funds in the fund exceeds $3 million. It is constantly growing due to the reinvestment of income and the growth in the value of its assets. At least 1 month should be considered as a recommended investment period, the longer it is — the more stable the result. The Esperio’s investment portfolios listed earlier and this fund together provide great investment opportunities. Our clients can choose the most suitable option or distribute funds among different ones.